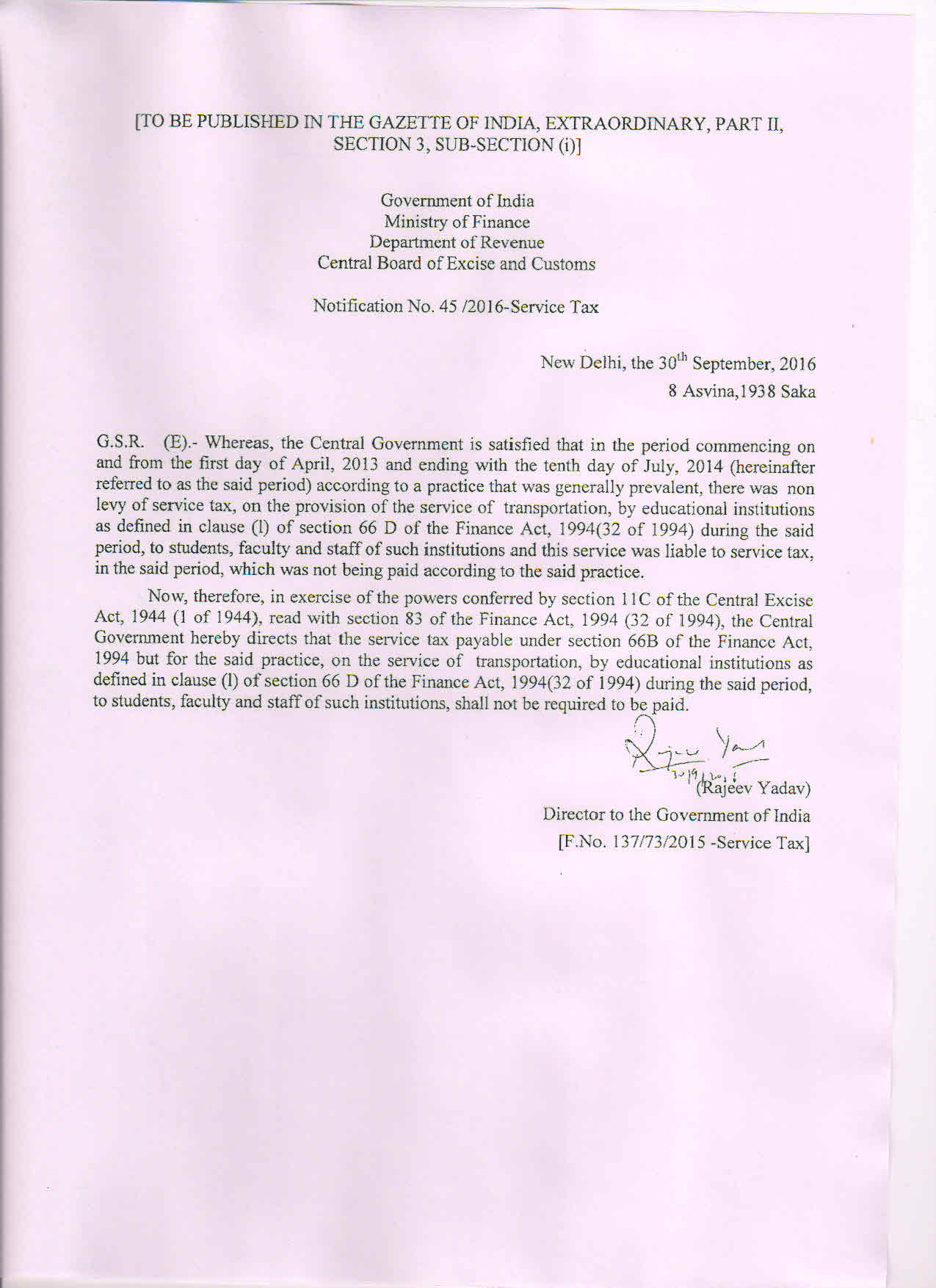

In a major relief to the Education Institution’s across India, the Central Government has issued Notification No. 45/2016 – Service Tax dated 30th Day of September, 2016, in exercise of the power conferred u/s 11C of the Central Excise Act, 1944 (1 of 1944), read with Section 83 of the Finance Act, 1994 (32 of 1994), whereby it has been directed that “…the service tax payable under section 66B of the Finance Act, 1994 but for the said practice, on the service of transportation, by education institutions as defined in clause (1) of section 66D of the Finance Act, 994 (32 of 1994) during the said period, to students faculty and staff of such institutions, shall not be required to be paid.”

We have taken-up this matter to the Central Government through CBEC vide our meeting and physical representation to the panel of CBEC headed by the Commissioner – Service Tax, CBEC, Sh. S. M. Tata on 31-05-2016 at the Ministry of Finance, North Block, New Delhi to explain him the ground realities and the impact of such retrospective taxation on the Education Sector. The matter was thoroughly discussed and evaluated by the Panel and it was suggested to Initiate the proceedings u/s 11 C of the Central Excise Act, 1944 (1 of 1944). In compliance to the above discussion and further information collected by CBEC from various Commissionerates across India, a recommendation has been given by the CBEC to the Central Government on this issue. The Central Government on the Recommendation of the CBEC, the Central Government has issued the Notification u/s 11c to grant the Relief to the Education Sector. LINK – https://blog.ritulpatwa.com/relief-to-education-institution-service-tax-on-transportation-fees-01-04-13-to-10-07-14/

It has come to our notice that in few cases the Service Tax Department has also covered Boarding (Hostel) Fees received by education institutions under the coverage of Service Tax going beyond the previous instruction of the TRU to initiate SCN in respect of the Transportation Fees received by the Education Institutions during the period from 01-04-2013 to 10-07-2014. In these cases a proper presentation and explanation will have to be given to the department to make them understand that Boarding (Hostel) Fees is an exempted service under the Negative List and need not be covered under the Auxiliary Education Service.