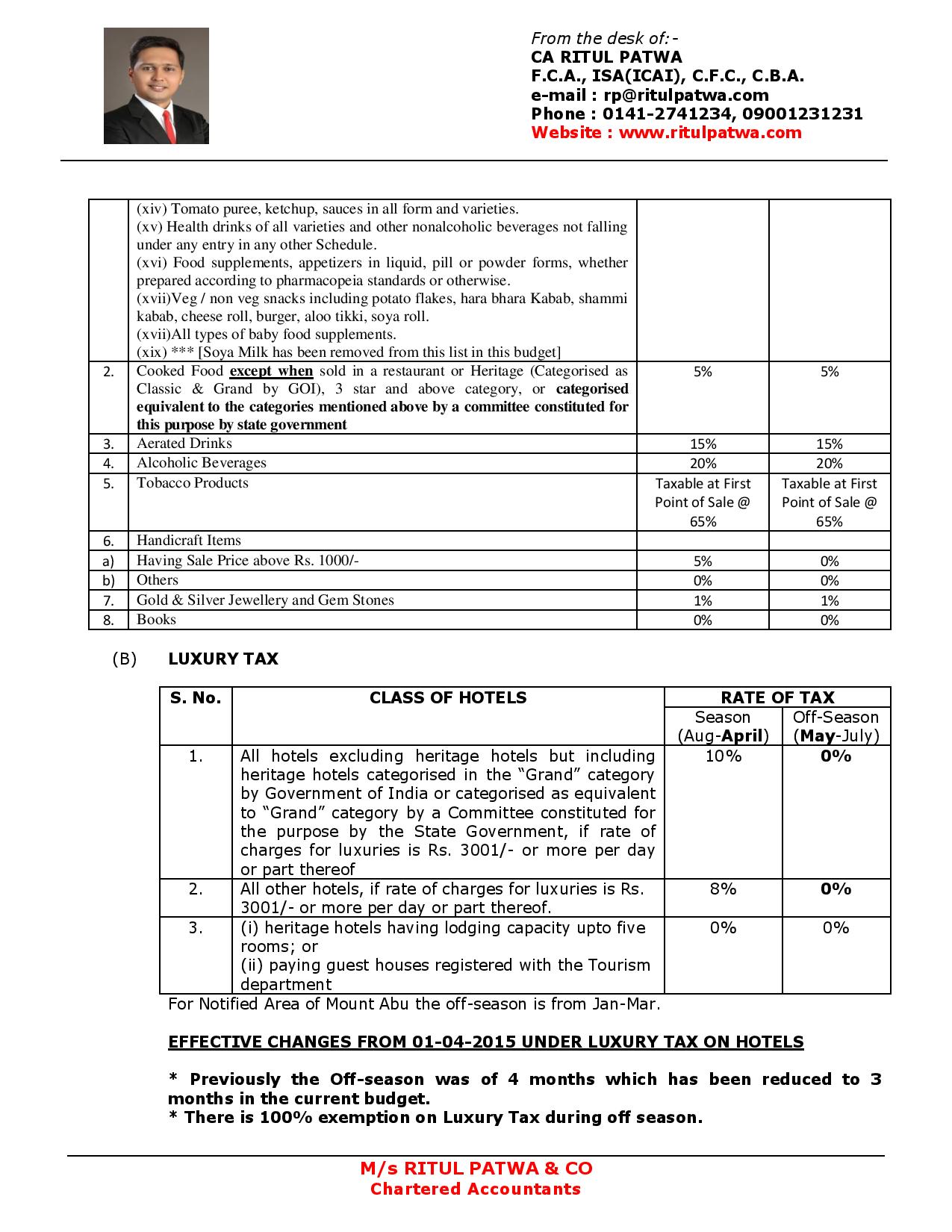

We are enclosing the Rate of VAT and Luxury Tax on Hotels and Restaurants in Rajasthan applicable after the State Budget, 2015.

ATTENTION – These changes in rates are applicable with immediate effect i.e. 09-03-2015.

The major changes are:-

1. Peak Rate of VAT has been increased from 14% to 14.50%.

2. Cooked food like Pizza, burgers, fried chicken, French fries, sandwich, hot dog, noodles, potato chips, bakery items and any other cooked food items served and sold including home delivery thereof OTHER THAN under a brand name by any branded chain outlet of cooked food shall be taxed under VAT at applicable for other cooked food instead of peak rate of 14%. Therefore going forward these items will be charged @5% in all hotels where the rate of VAT for cooked food is 5%.