In accordance with the COVID-19 – Regulatory Package notification dated Mar 27, 2020 issued by Reserve Bank of India (“RBI”) and as may be updated from time to time (“Covid Regulation”), a moratorium of three months is available on payment/repayment of (i) principal and/or interest components; (ii) bullet repayments; (iii) equated monthly instalments; and/ or (iv) Credit Card dues, as the case may be in respect of all instalments/payments falling due between the period beginning Mar 01 until May 31, 2020 (“Moratorium”).

As per guidelines issued by the respective banks, the borrower(s)/ customer(s) can choose to OPT-IN or OPT-OUT, for availing of the Moratorium in respect of the credit facility(ies) availed.

We are discussing the Frequently Asked Questions (FAQs) with regard to the various aspects of the deferment scheme of Bank Loan Repayment, EMI, Instalments, Interest, Principal etc for easy understanding of layman. This information is compiled from the RBI guidelines and the information provided by few leading banks and provide an overview of the Scheme, however there may be certain operational differences from Bank to Bank.

Frequently Asked Questions (FAQs)

FAQ 1 : Will all Borrowers automatically be given the benefit of Moratorium period ?

Reply : It may differ from bank to bank. Each Bank & Financial Institution has prescribed its own procedure to avail Moratorium on EMI, Installment, Interest for deferment in view of the RBI COVID19 Regulatory Package. Some Banks and FIs have approved automatic moratorium, while others have provided option to its Borrowers to opt for moratorium through its Website Liks, E-Mail ID, SMS etc.

We are noting below the Website Link for details on EMI Moratorium due to COVID19 for major banks & Financial Institutions below:-

a) State Bank of India (SBI) EMI Moratorium Link – https://www.sbi.co.in/stopemi

b) Bank of Baroda (BOB) EMI Moratorium Link – https://www.bankofbaroda.in/covid-19-related-faqs.htm

c) ICICI Bank EMI Moratorium Link – https://buy.icicibank.com/moratorium.html?ITM=nli_cms_hp_1_static_EMI-moratorium-d_ChooseYourOption

d) HDFC Bank EMI Moratorium Link – https://apply.hdfcbank.com/vivid/afp?product=mo

e) Punjab National Bank (PNB) EMI Moratorium Link – https://www.pnbhousing.com/covid-19-moratorium-regulatory-package-rbi/

f) Kotak Mahindra Bank EMI Moratorium Link – https://www.kotak.com/content/dam/Kotak/banks-policy-on-covid-related-reschedulement-of-dues.pdf

g) Bank of India (BOI) EMI Moratorium Link – https://bankofindia.co.in/pdf/FAQs_COVID19.pdf

h) Axis Bank EMI Moratorium Link – https://www.axisbank.com/avail-moratorium-on-bank-emi

i) Tata Capital EMI Moratorium Link – https://www.tatacapital.com/rbi-emi-moratorium-during-covid-19.html

j) L&T Capital EMI Moratorium Link – https://www.ltfs.com/companies/lnt-housing-finance/faqs-emi-moratorium-housing-finance.html

k) Bajaj Finance EMI Moratorium Link – https://www.bajajfinserv.in/BFL_Covid19_Moratorium_FaQs-for-Customers-30Mar20.pdf

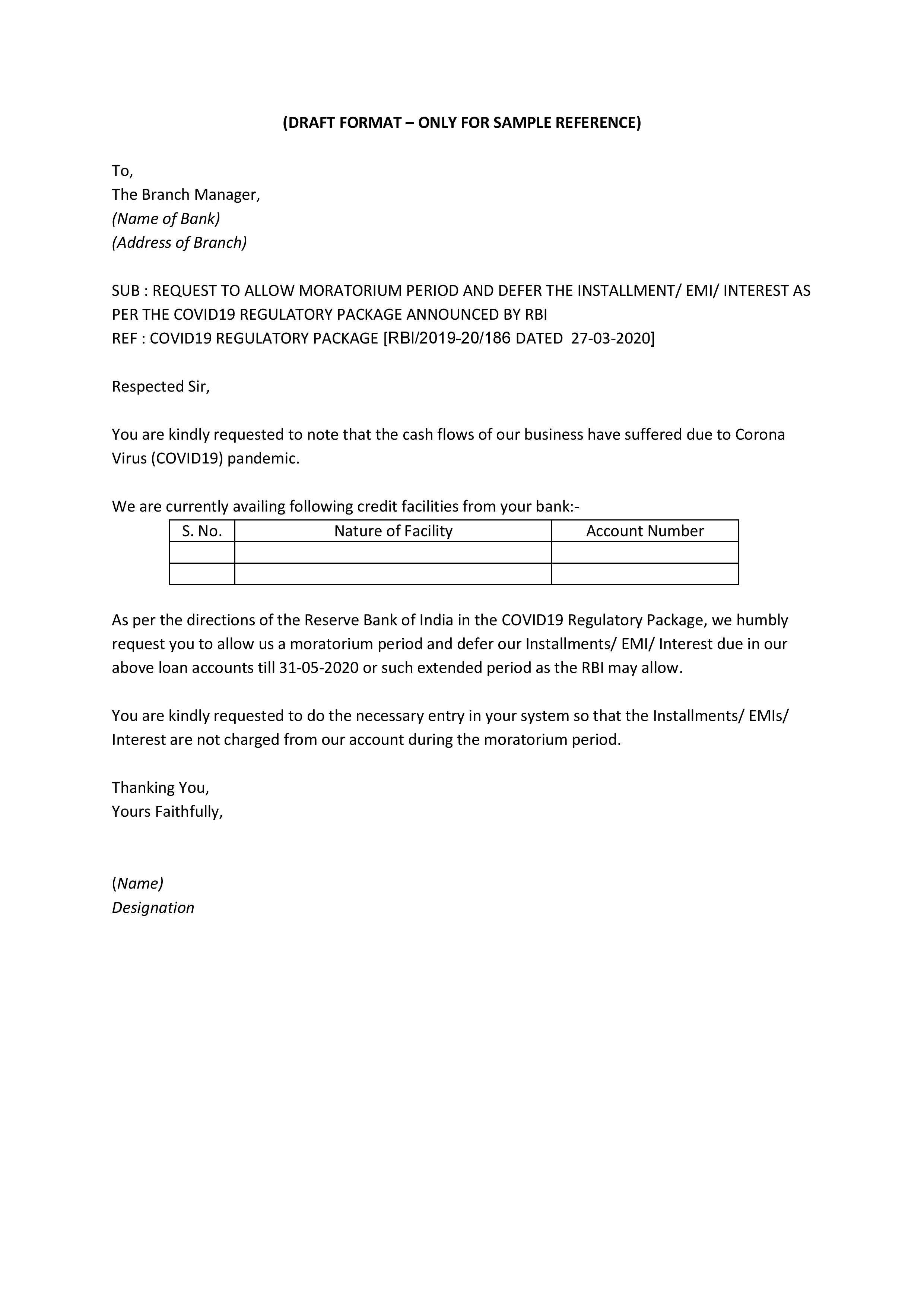

FOR THOSE BORROWERS WHO WANT TO AVAIL MORATORIUM PERIOD AND DUE TO ANY REASON UNABLE TO OPT THROUGH THE BANK/ FI PRESCRIBED PROCEDURE, IT IS SUGGESTED TO SEND A MAIL TO YOUR RESPECTIVE BANK BRANCH WITH DETAILS OF FACILITIES AVAILED AND REQUEST TO ALLOW MORATORIUM – DRAFT / SAMPLE LETTER FORMAT ATTACHED BELOW.

FAQ 2 : Is moratorium compulsory or optional?

REPLY : The moratorium is optional for all kinds of credit facilities such as retail loans, Home Loans, Business Loans, Cards and Farmer Loans.

FAQ 3 : What is meant by moratorium?

REPLY : Moratorium is temporary postponement of payment of interest/ principal/ instalments (and is not a waiver) for the period from Mar 01 to May 31, 2020. Interest will be payable on all amount(s) for which payment is being postponed pursuant to the Moratorium.

FAQ 4 : For what period can the moratorium be granted?

REPLY : A moratorium may be granted up to a period of three months for all amounts falling due between Mar 01 and May 31, 2020.

FAQ 5 : Is the moratorium on principal or interest or both?

REPLY : Moratorium can be offered for below payments due during the moratorium period.

(i) principal and/or interest components;

(ii) bullet repayments;

(iii) Equated Monthly Instalments or EMIs;

(iv) Credit Card dues.

FAQ 6 : Will the interest accrue during the moratorium period?

REPLY : Yes, the interest will accrue during the moratorium period. Treatment of the interest will be as per the relevant terms and conditions applicable to the respective credit facilities.

FAQ 7 : How can I opt for the moratorium?

REPLY : You can opt for the moratorium by clicking on the link shared with you by the Bank through (i) SMS or (ii) e-mail. You may also visit the Bank’s website for the option. We suggest to also send an E-Mail to your respective branch with request for deferment of payment during the moratorium period.

FAQ 8 : How will interest be charged and recovered for retail term loans such as Home Loans, Personal Loans, Consumer Durable Loans, Two-Wheeler Loans, Auto Loans?

REPLY : The accrued interest would be added to the principal amount which will increase the residual tenure of the loan except in cases where extension of tenure is not possible in which case the EMI amount will increase. Please refer to the relevant applicable terms and conditions for further details.

Illustration: Mr Ram Kumar availed of a housing loan in Mar 01, 2020 amounting to Rs one crore with loan tenure of 236 months. If Mr Ram Kumar wants to avail of moratorium of instalment of Rs 90,521.00 which is due on Apr 01, 2020 then the interest for the month of March amounting to Rs 75,000 will be added to the principal amount and revised opening principal amount on Apr 01, 2020 will become Rs 10,075,000. The interest will be computed on revised principal. Similarly, the interest for the month of April which is payable on May 01, 2020 of Rs 75,562 will be added to the opening principal on May 01, 2020 which will be Rs 10,150,562. The interest will be computed on revised principal. In this case Mr Ram Kumar’s tenure will increase from 236 months to 249 months considering the unchanged rate of interest and instalment amount during this period.

FAQ 9 : How will interest be charged and recovered for cash credit/ overdraft facilities?

REPLY : The accrued interest will be due and payable immediately after the end of the moratorium i.e. in Jun 2020. Please refer to the relevant applicable terms and conditions for further details. The postponed interest (funded interest) shall carry interest at the rate applicable on the credit facility and the underlying security shall continue to secure the funded interest.

FAQ 10 : How will interest be charged and recovered for Business Term Loans?

REPLY : Please refer to the relevant applicable terms and conditions for details. On a case-to-case basis, the postponed interest accrued during the moratorium period may be considered as a postponed interest term loan. Such postponed interest term loan shall further carry interest at the rate applicable to the credit facility.

FAQ 11 : Will there be late payment charges/ default interest/ additional interest for the deferred instalments during the moratorium period?

REPLY : No late payment charges/ default interest/ additional interest shall be levied during the moratorium period.

FAQ 12 : If the customer has already availed of a moratorium for an Education Loan, can the tenure get extended on account of the Covid Regulation?

REPLY : No, since the repayment for such customers will start in future and the moratorium is for customers whose repayment (interest or EMI) is active in the period Mar 01 to May 31, 2020.

FAQ 13 : If customer has principal moratorium running in Education Loan, can he/she still avail of this facility?

REPLY : Yes, the moratorium is available for interest amounts payable.

FAQ 14 : Do I need to submit fresh Auto Debit or NACH debit mandates?

REPLY : No, as the EMI will remain same and tenure will increase to recover the deferred interest accrued during the moratorium period, there is no need of fresh Auto Debit (AD) or NACH mandate. If you opt for moratorium, the residual tenure will increase to recover the accrued interest during moratorium period. However, in case the instalment amount increases, then a fresh NACH mandated will be required.

FAQ 15 : Can I make payments in between the Moratorium period?

REPLY : It is a relief granted to the borrower due to disruption caused due to unprecedented outbreak of COVID-19. However, the option lies with the borrower to either repay the loan during this moratorium as per the actual due dates or avail of the benefit of the Moratorium.

FAQ 16 : Will a payment of EMI during the moratorium be considered as prepayment?

REPLY : If the due EMI is paid, then it will not be considered as prepayment and there will not be any prepayment penalty on the same.

FAQ 17 : Will the seeking of Moratorium by the borrower have an impact on their credit/bureau score?

REPLY : The moratorium on payments will not qualify as a default for the purposes of supervisory reporting and reporting to Credit Information Companies (CICs)/credit bureau by the Bank. Hence, there will be no adverse impact on the credit history of the borrowers.

Any delay in payments of dues/ outstanding amounts payable after the expiry of the Moratorium for customers(s)/ borrower(s) who had availed of the Moratorium will qualify for the purposes of reporting to Credit Information Companies (CICs)/credit bureau by the Bank.

FAQ 18 : For the retail Term Loans, can I pay all 3 months’ EMI in Jun 2020?

REPLY : As the tenure of the retail term loans has been extended on account of the moratorium, the customer is required to pay the EMIs as per the revised schedule. However, as per terms and conditions of the facility, if prepayment is permitted then you may pay the EMIs in Jun 2020.

FAQ 19 : If I have sufficient balance in my account and instalment of my loan(s) is due, will the Bank debit the EMI during this period?

REPLY : Yes, if you have not opted in for the moratorium.

FAQ 20 : Does the customer need to submit any documents for availing of the Moratorium?

REPLY : No, you can opt for the moratorium by clicking on the link shared with you by the Bank through (i) SMS or (ii) e-mail. You may also visit the Bank’s website for the option. In case of doubt, we suggest to also send an E-Mail to your respective branch with request for deferment of payment during the moratorium period.

FAQ 21 : Is it ok if I continue paying the EMIs rather than availing of the moratorium?

REPLY : Yes, please continue to pay your EMI

FAQ 22 : Can I opt moratorium for EMI due in April and then pay EMI due in May?

REPLY : Yes, it is permitted.

FAQ 23 : As per RBI, the moratorium is for 3 EMIs, can I get refund of EMI paid in Mar 2020?

REPLY : No. EMI paid prior to Mar 27, 2020 will not be refunded. However, if any EMI is debited after Mar 27, 2020 and the borrower/ customer opts for moratorium then such EMI maybe considered for refund at the request of the borrower/ customer.

FAQ 24 : Due to COVID-19 outbreak, my business/job was impacted in the month of Mar 2020 hence I could not pay the EMI. Can I get moratorium for unpaid EMI?

REPLY : Yes, you will be eligible for moratorium for EMI due in Mar 2020.

FAQ 25 : If my loan disbursement is done in Apr 2020, then would I be eligible for moratorium?

REPLY : Yes, if your instalment/payment falls due on or before May 31, 2020.

FAQ 26 : If I have not opted for moratorium, whether Bank will debit interest and instalment during this period?

REPLY : Yes, if you have not opted in for the moratorium.

FAQ 27 : My payment on bill discounting facility/FCNR facility is due during moratorium period, can I avail of extension for repayment?

REPLY : You can opt for the moratorium by clicking on the link shared with you by the Bank through (i) SMS or (ii) e-mail. You may also visit the Bank’s website for the option. In case of doubt, we suggest to also send an E-Mail to your respective branch with request for deferment of payment during the moratorium period.

FAQ 28 : In case of multiple facilities availed from the Bank, whether the moratorium is applicable for all facilities?

You need to specifically select every facility for availing of moratorium for the respective type of credit facility. You can opt for the moratorium by clicking on the link shared with you by the Bank through (i) SMS or (ii) e-mail. You may also visit the Bank’s website for the option. In case of doubt, we suggest to also send an E-Mail to your respective branch with request for deferment of payment during the moratorium period.

B. ADDITIONAL FAQs SPECIFIC TO CREDIT CARDS

FAQ 1 : Do I need to pay my Credit Card outstanding during the moratorium period?

REPLY : No, payment needs to be made during the moratorium period. During the moratorium period, as per the billing cycle dates, interest charges (at standard interest rate as per the card variant in accordance with the applicable terms and conditions) will be levied.

FAQ 2 : What would be the interest accrued/charged on my Credit Card dues?

REPLY : For all Credit Card dues (including any unpaid EMIs till the respective payment due date), standard interest rates of the card variant as per the applicable terms and conditions will be levied. For all EMI transaction, the interest rate specified at the time of availing of EMI facility would be levied.

FAQ 3 : Can I make payment if I opt for moratorium on Credit Card?

REPLY : Yes, you can make payment against the outstanding amount during moratorium period. The interest would be levied only for remaining outstanding amount (as per standard interest rate of the card variant as per the applicable terms and conditions).

FAQ 4 : Will Late Payment charges be levied during moratorium period?

REPLY : If you opt for moratorium on your Credit Card, no late payment charges will be levied.

FAQ 5 : Will the interest be charged from due date of payment or purchase date?

REPLY : The interest will be levied from purchase/transaction date as per standard interest rate of the card variant as mentioned in the applicable terms and conditions.

FAQ 6 : For all purchases made on the Credit Card during moratorium period, will I be charged interest?

REPLY : Any unpaid dues in moratorium period will also attract interest charges (as per standard interest rate of the card variant as mentioned in applicable terms and conditions) if not paid within its interest-free period (Grace period) i.e. by the respective payment due date. For understanding of interest-free period (Grace period) and calculation of interest charges, kindly refer the terms and conditions of you Credit Card from the respective Bank Website.

FAQ 7 : When do I need to make the payment after Moratorium period is over?

REPLY : The payment for all unpaid balances, EMIs as on date of Moratorium application, all new transactions done between Moratorium start date till May 31, 2020 and interest charges levied during the period need to be made as per your Jun 2020 billing cycle’s payment due date. The amount mentioned in your Jun 2020 statement would include all previous outstanding against which payment is not done, principal amount on transactions done during Moratorium period and interest levied on these transactions and interest on Personal Loan on Credit Card (PLCC) and EMI transactions.

FAQ 8 : If I avail of the Moratorium facility, how will my EMIs be recovered after the period is over for Credit Card transactions? Is it single debit of all the EMIs put together or will my EMIs will be debited monthly as usual?

REPLY : As EMIs are billed in your regular Credit Card statement cycle, EMIs would continue to be billed in your statement as per the original amortisation schedule. For example, if your EMI was to be billed on Apr 15, May 15 and Jun 15, and you have availed of the moratorium benefit on Apr 05, the EMIs would still be billed on Apr 15, May 15 and Jun 15. The payment for these billed transactions will need to be done as per the payment due date of the Jun 2020 statement to avoid any penal late payment. In case of non-payment of statement dues (which includes EMIs billed) by the respective payment due dates, interest charges will accrue at the standard interest rates (as per standard interest rate of the Credit Card variant as mentioned in the applicable terms and conditions).

FAQ 9 : Will my Credit Card statement be generated during the moratorium period?

REPLY : Yes, the Credit Card statements will be generated and shared during the moratorium period, but no payment needs to be made against the same. In case of non-payment of total statement dues by the respective payment due dates, interest will be accrued at standard interest rate (as per standard interest rate of the Credit Card variant as mentioned in Credit Cards Most Important Terms and Conditions) and levied in statements generated during the moratorium period also, which will need to be paid after the end of moratorium i.e. by payment due date of Jun 2020 statement.

FAQ 10 : I have set an auto debit on my Credit Card for payment. Will the auto debit facility be triggered during moratorium period?

REPLY : Auto debit will not be triggered during the moratorium period if you have opted in for moratorium. Auto debit facility would be restored from Jun 2020 statement cycle at pre-moratorium configuration.

FAQ 11 : I have multiple Credit Cards of ICICI Bank; can I opt for moratorium on only one of my cards?

REPLY : No, if you opt for moratorium on any one Credit Card, it will be applicable on all Credit Cards held by you.

FAQ 12 : Can I close my PLCC / EMI on Credit Card (CC) / EMI on Debit Card (DC) / Balance Transfer during moratorium period?

REPLY : If you opt in for moratorium, you will still be allowed to close any of the PLCC / EMI on CC / EMI on DC / Balance Transfer during moratorium period as per the existing terms and conditions applicable to the respective products/facilities.

FAQ 13 : Can I avail of PLCC or EMI on call or balance transfer after I opt for moratorium period?

REPLY : You will not be allowed to apply for PLCC or convert your transactions into EMI once you opt for moratorium. No balance transfer into the statement would be allowed during moratorium period.

FAQ 14 : Will I earn reward points on the transactions done during moratorium period?

REPLY : You will keep on earning reward points on your transactions as per your card’s policy. The rewards will be credited in your PAYBACK/MMT/Amazon/Intermiles Account, post statement generation in moratorium period also.

FAQ 15 : Will I be able to change my statement cycle during moratorium period?

REPLY : If you opt in for moratorium, you will not be able to change your statement cycle.

FAQ 16 : Will my credit limit be changed during moratorium period?

REPLY : Your credit limit can be modified (decreased/restored) as per the discretion of the Bank during the moratorium period as per the applicable terms and conditions.

FAQ 17 : Will I be able to transact with my Credit Card during the moratorium period?

REPLY : If you opt in for moratorium, while you will be able to transact, your transaction privileges may be modified as per the discretion of the Bank during the moratorium period.

FAQ 18 : What all cards are applicable for moratorium period?

REPLY : All Credit Cards are eligible for moratorium.

FAQ 19 : What is the impact if I do not opt in for moratorium on my Credit Card?

REPLY : If you do not opt for moratorium on your Credit Card; regular statement would be generated on your Credit Card as per your existing billing cycles and all existing terms and conditions with respect to credit fee period, applicable fees and interest will apply as mentioned in Credit Cards Most Important Terms and Conditions (MITC).