Constitutional validity of Aadhaar has been upheld by the Hon’ble Supreme Court of India in September 2018. Consequently, in terms of Section 139AA of Income Tax Act., 1961 and order dated 30.6.2018 (F. No. 225/270/2017/ITA.II) of the Central Board of Direct Taxes, Aadhaar-PAN linking is mandatory now which has to be completed till 31.3.2019 by the PAN holders requiring filing of Income Tax Return.

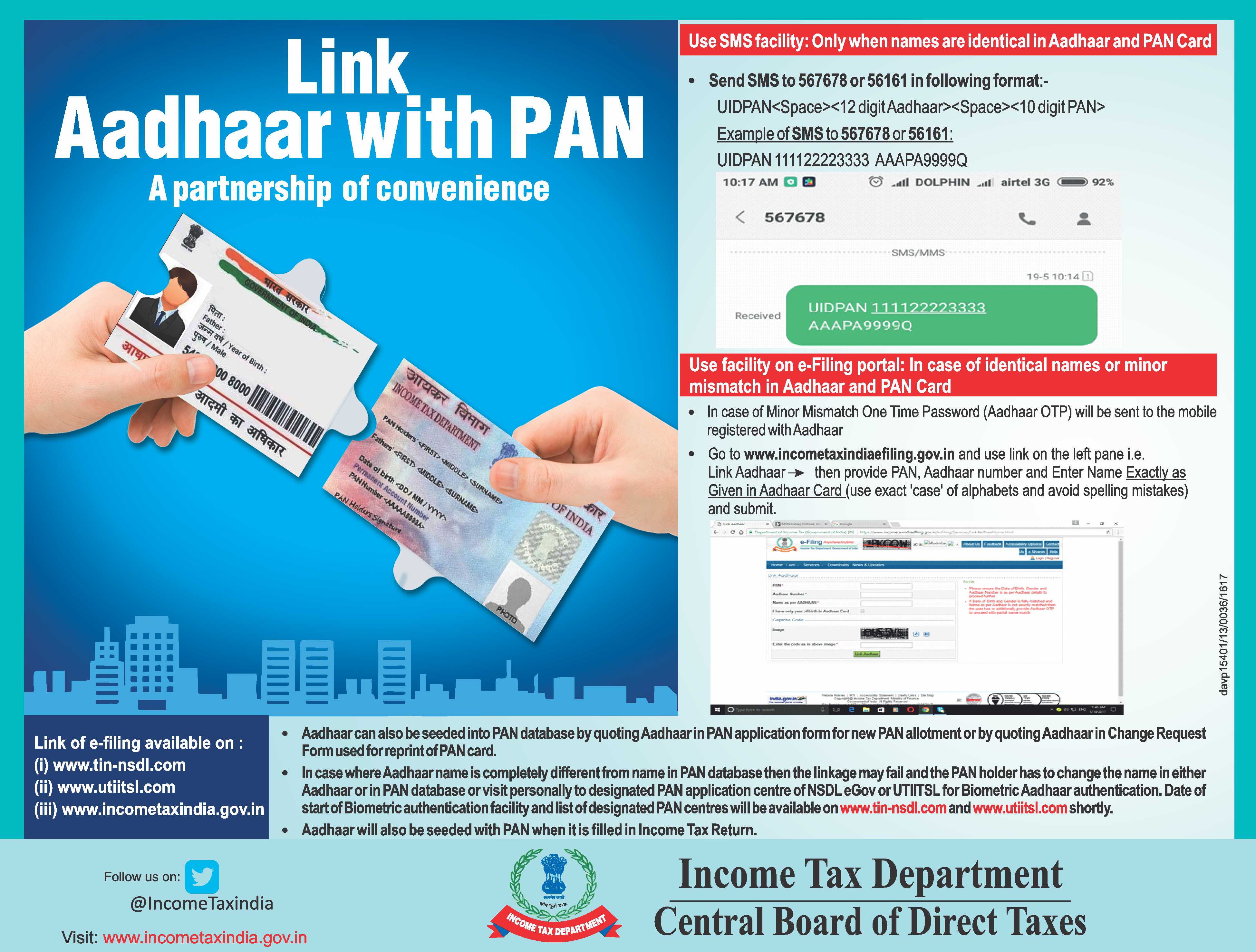

Procedure for Aadhaar PAN linking has been published vide notification no. 7 dated 29.6.2017 by Pr. Director General of Income Tax(Systems).

—

Requirement for Quoting of Aadhaar number under Income Tax Act, 1961:-

Section 139AA. (1) Every person who is eligible to obtain Aadhaar number shall, on or after the 1st day of July, 2017, quote Aadhaar number—

(i) in the application form for allotment of permanent account number;

(ii) in the return of income:

Provided that where the person does not possess the Aadhaar Number, the Enrolment ID of Aadhaar application form issued to him at the time of enrolment shall be quoted in the application for permanent account number or, as the case may be, in the return of income furnished by him.

(2) Every person who has been allotted permanent account number as on the 1st day of July, 2017, and who is eligible to obtain Aadhaar number, shall intimate his Aadhaar number to such authority in such form and manner as may be prescribed, on or before a date to be notified by the Central Government in the Official Gazette:

Provided that in case of failure to intimate the Aadhaar number, the permanent account number allotted to the person shall be deemed to be invalid and the other provisions of this Act shall apply, as if the person had not applied for allotment of permanent account number.

(3) The provisions of this section shall not apply to such person or class or classes of persons or any State or part of any State, as may be notified by the Central Government in this behalf, in the Official Gazette.

Explanation.—For the purposes of this section, the expressions—

(i) “Aadhaar number”, “Enrolment” and “resident” shall have the same meanings respectively assigned to them in clauses (a), (m) and (v) of section 2 of the Aadhaar (Targeted Delivery of Financial and other Subsidies, Benefits and Services) Act, 2016 (18 of 2016);

(ii) “Enrolment ID” means a 28 digit Enrolment Identification Number issued to a resident at the time of enrolment.]