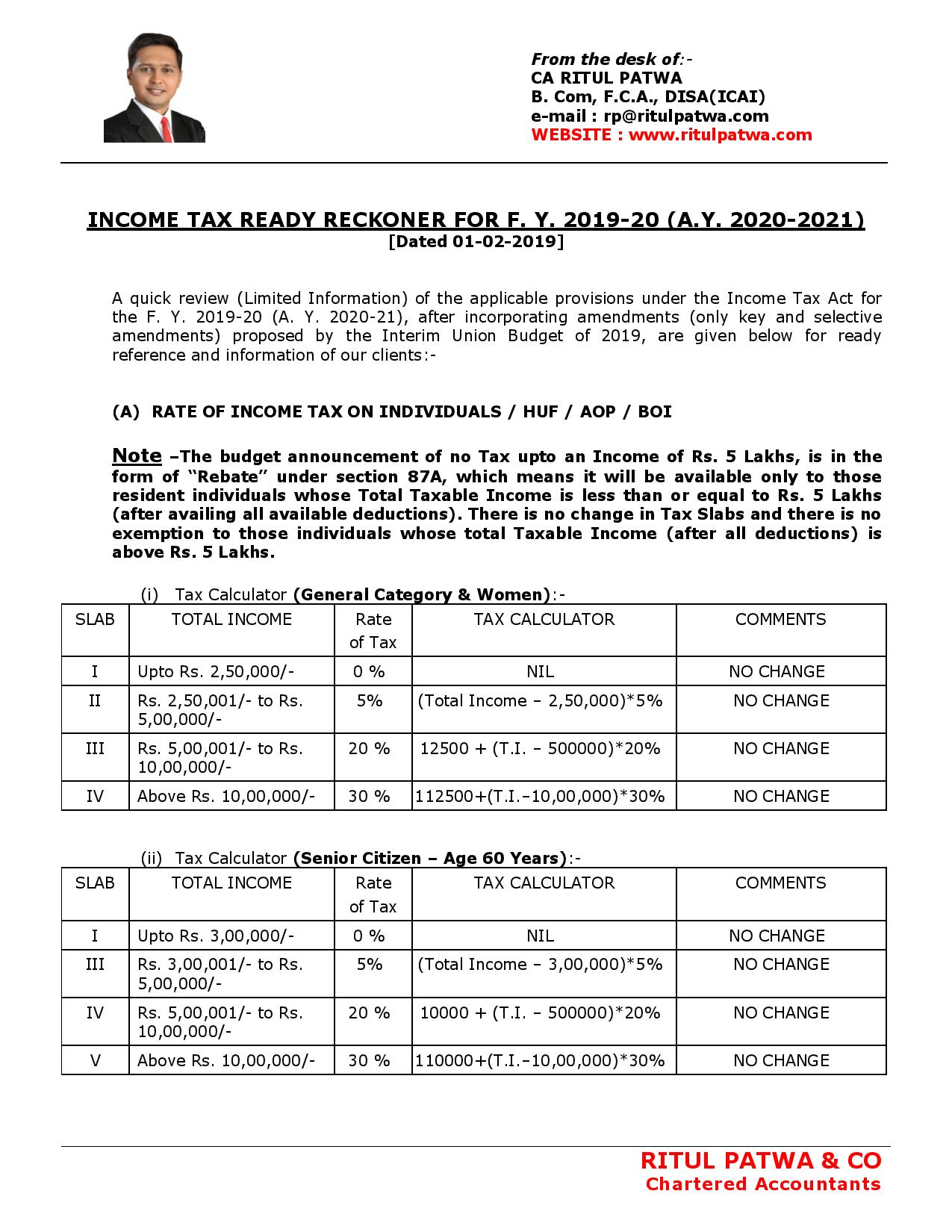

(A) RATE OF INCOME TAX ON INDIVIDUALS / HUF / AOP / BOI

| SLAB | TOTAL INCOME | Rateof Tax | TAX CALCULATOR | COMMENTS |

| I | Upto Rs. 2,50,000/- | 0 % | NIL | NO CHANGE |

| II | Rs. 2,50,001/- to Rs. 5,00,000/- | 5% | (Total Income – 2,50,000)*5% | NO CHANGE |

| III | Rs. 5,00,001/- to Rs. 10,00,000/- | 20 % | 12500 + (T.I. – 500000)*20% | NO CHANGE |

| IV | Above Rs. 10,00,000/- | 30 % | 112500+(T.I.–10,00,000)*30% | NO CHANGE |

(ii) Tax Calculator (Senior Citizen – Age 60 Years):-

| SLAB | TOTAL INCOME | Rateof Tax | TAX CALCULATOR | COMMENTS |

| I | Upto Rs. 3,00,000/- | 0 % | NIL | NO CHANGE |

| III | Rs. 3,00,001/- to Rs. 5,00,000/- | 5% | (Total Income – 3,00,000)*5% | NO CHANGE |

| IV | Rs. 5,00,001/- to Rs. 10,00,000/- | 20 % | 10000 + (T.I. – 500000)*20% | NO CHANGE |

| V | Above Rs. 10,00,000/- | 30 % | 110000+(T.I.–10,00,000)*30% | NO CHANGE |

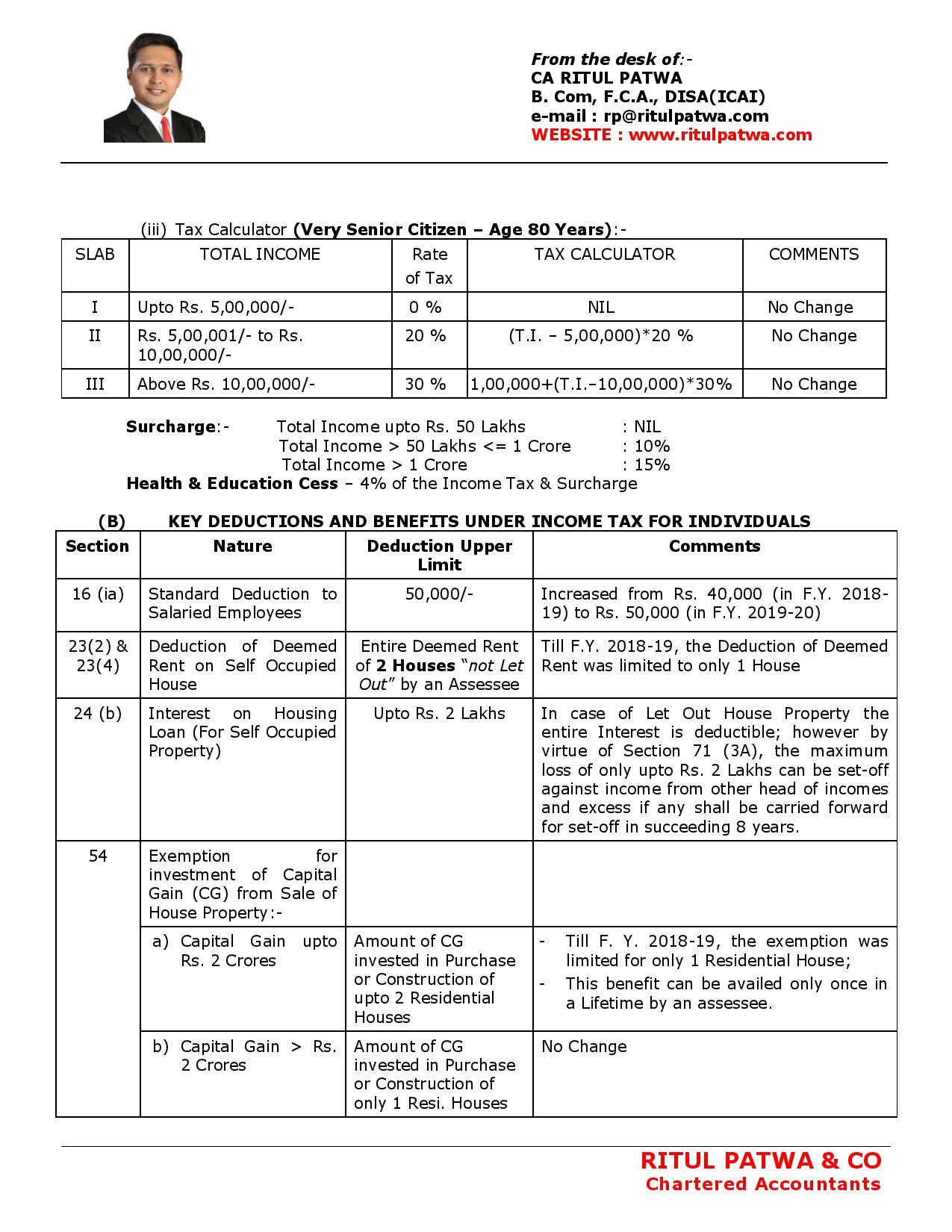

(iii) Tax Calculator (Very Senior Citizen – Age 80 Years):-

| SLAB | TOTAL INCOME | Rateof Tax | TAX CALCULATOR | COMMENTS |

| I | Upto Rs. 5,00,000/- | 0 % | NIL | No Change |

| II | Rs. 5,00,001/- to Rs. 10,00,000/- | 20 % | (T.I. – 5,00,000)*20 % | No Change |

| III | Above Rs. 10,00,000/- | 30 % | 1,00,000+(T.I.–10,00,000)*30% | No Change |

Surcharge:- Total Income upto Rs. 50 Lakhs : NIL

Total Income > 50 Lakhs <= 1 Crore : 10%

Total Income > 1 Crore : 15%

Health & Education Cess – 4% of the Income Tax & Surcharge

(B) KEY DEDUCTIONS AND BENEFITS UNDER INCOME TAX FOR INDIVIDUALS

| Section | Nature | Deduction Upper Limit | Comments |

| 16 (ia) | Standard Deduction to Salaried Employees | 50,000/- | Increased from Rs. 40,000 (in F.Y. 2018-19) to Rs. 50,000 (in F.Y. 2019-20) |

| 23(2) & 23(4) | Deduction of Deemed Rent on Self Occupied House | Entire Deemed Rent of 2 Houses “not Let Out” by an Assessee | Till F.Y. 2018-19, the Deduction of Deemed Rent was limited to only 1 House |

| 24 (b) | Interest on Housing Loan (For Self Occupied Property) | Upto Rs. 2 Lakhs | In case of Let Out House Property the entire Interest is deductible; however by virtue of Section 71 (3A), the maximum loss of only upto Rs. 2 Lakhs can be set-off against income from other head of incomes and excess if any shall be carried forward for set-off in succeeding 8 years. |

| 54 | Exemption for investment of Capital Gain (CG) from Sale of House Property:- | ||

| a) Capital Gain upto Rs. 2 Crores | Amount of CG invested in Purchase or Construction of upto 2 Residential Houses | – Till F. Y. 2018-19, the exemption was limited for only 1 Residential House;- This benefit can be availed only once in a Lifetime by an assessee. | |

| b) Capital Gain > Rs. 2 Crores | Amount of CG invested in Purchase or Construction of only 1 Resi. Houses | No Change | |

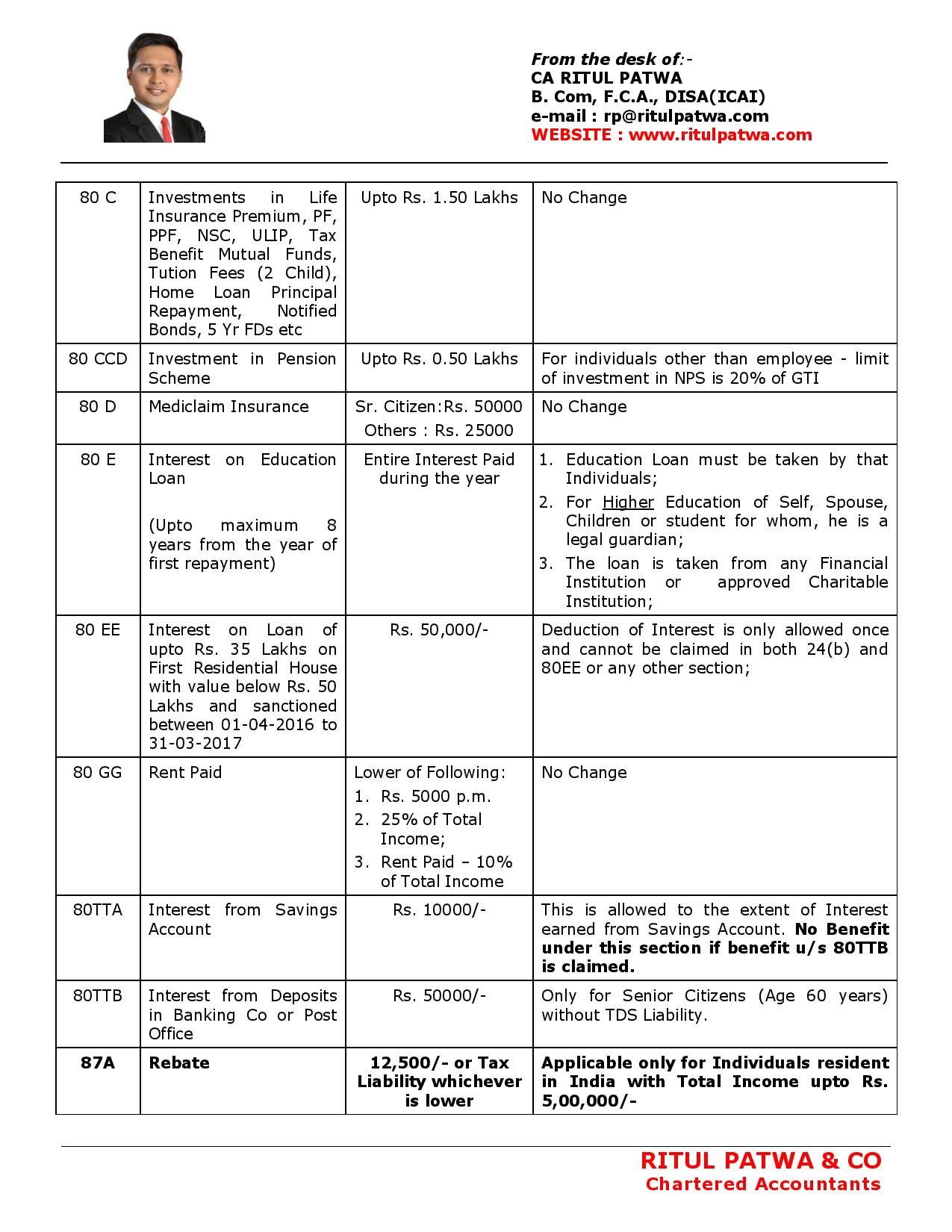

| 80 C | Investments in Life Insurance Premium, PF, PPF, NSC, ULIP, Tax Benefit Mutual Funds, Tution Fees (2 Child), Home Loan Principal Repayment, Notified Bonds, 5 Yr FDs etc | Upto Rs. 1.50 Lakhs | No Change |

| 80 CCD | Investment in Pension Scheme | Upto Rs. 0.50 Lakhs | For individuals other than employee – limit of investment in NPS is 20% of GTI |

| 80 D | Mediclaim Insurance | Sr. Citizen:Rs. 50000Others : Rs. 25000 | No Change |

| 80 E | Interest on Education Loan

(Upto maximum 8 years from the year of first repayment) |

Entire Interest Paid during the year | 1. Education Loan must be taken by that Individuals;2. For Higher Education of Self, Spouse, Children or student for whom, he is a legal guardian;

3. The loan is taken from any Financial Institution or approved Charitable Institution; |

| 80 EE | Interest on Loan of upto Rs. 35 Lakhs on First Residential House with value below Rs. 50 Lakhs and sanctioned between 01-04-2016 to 31-03-2017 | Rs. 50,000/- | Deduction of Interest is only allowed once and cannot be claimed in both 24(b) and 80EE or any other section; |

| 80 GG | Rent Paid | Lower of Following:1. Rs. 5000 p.m.

2. 25% of Total Income; 3. Rent Paid – 10% of Total Income |

No Change |

| 80TTA | Interest from Savings Account | Rs. 10000/- | This is allowed to the extent of Interest earned from Savings Account. No Benefit under this section if benefit u/s 80TTB is claimed. |

| 80TTB | Interest from Deposits in Banking Co or Post Office | Rs. 50000/- | Only for Senior Citizens (Age 60 years) without TDS Liability. |

| 87A | Rebate | 12,500/- or Tax Liability whichever is lower | Applicable only for Individuals resident in India with Total Income upto Rs. 5,00,000/- |

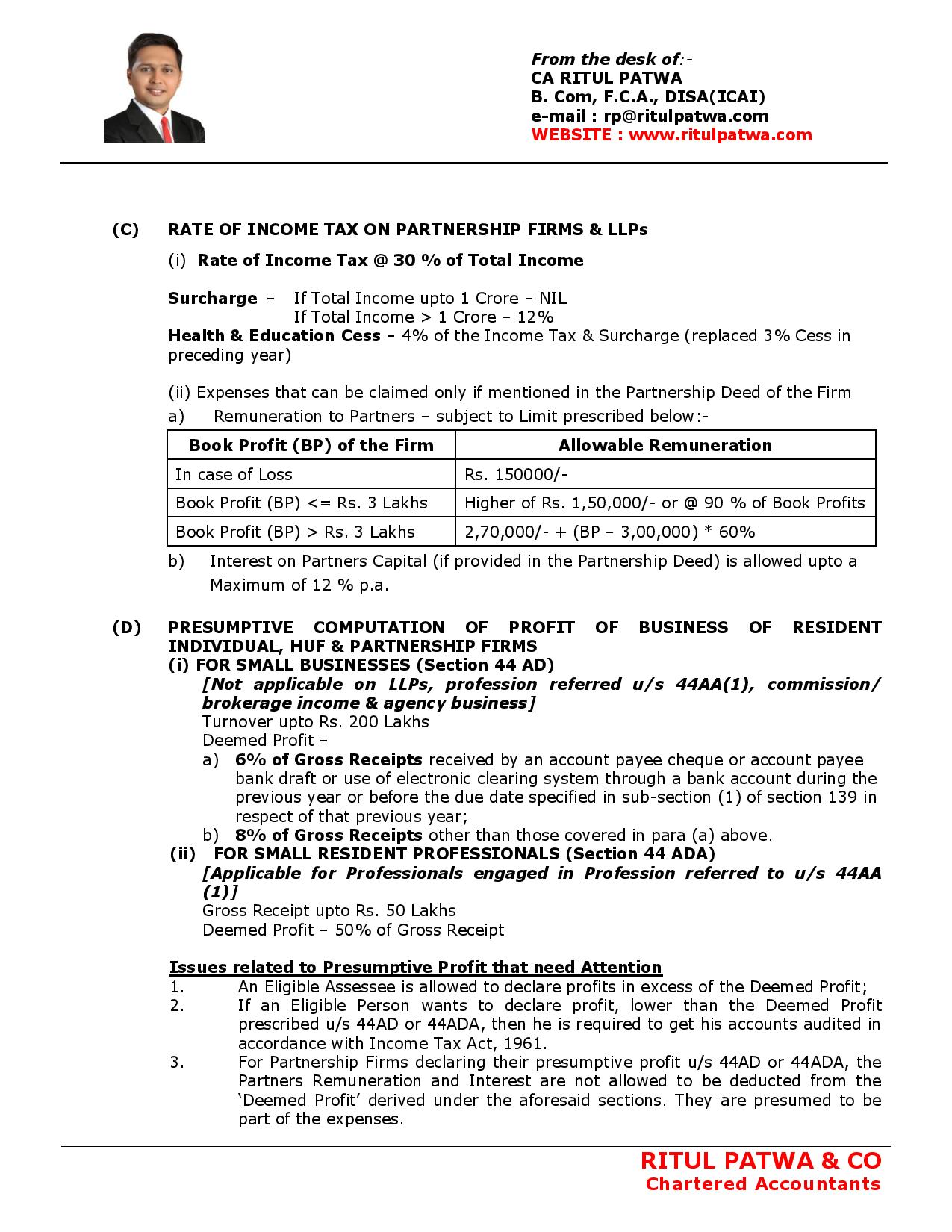

(C) RATE OF INCOME TAX ON PARTNERSHIP FIRMS & LLPs

(i) Rate of Income Tax @ 30 % of Total Income

Surcharge – If Total Income upto 1 Crore – NIL

If Total Income > 1 Crore – 12%

Health & Education Cess – 4% of the Income Tax & Surcharge (replaced 3% Cess in preceding year)

(ii) Expenses that can be claimed only if mentioned in the Partnership Deed of the Firm

- Remuneration to Partners – subject to Limit prescribed below:-

| Book Profit (BP) of the Firm | Allowable Remuneration |

| In case of Loss | Rs. 150000/- |

| Book Profit (BP) <= Rs. 3 Lakhs | Higher of Rs. 1,50,000/- or @ 90 % of Book Profits |

| Book Profit (BP) > Rs. 3 Lakhs | 2,70,000/- + (BP – 3,00,000) * 60% |

- Interest on Partners Capital (if provided in the Partnership Deed) is allowed upto a

Maximum of 12 % p.a.

(D) PRESUMPTIVE COMPUTATION OF PROFIT OF BUSINESS OF RESIDENT INDIVIDUAL, HUF & PARTNERSHIP FIRMS:-

(i) FOR SMALL BUSINESSES (Section 44 AD)

[Not applicable on LLPs, profession referred u/s 44AA(1), commission/ brokerage income & agency business]

Turnover upto Rs. 200 Lakhs

Deemed Profit –

- 6% of Gross Receipts received by an account payee cheque or account payee bank draft or use of electronic clearing system through a bank account during the previous year or before the due date specified in sub-section (1) of section 139 in respect of that previous year;

- 8% of Gross Receipts other than those covered in para (a) above.

(ii) FOR SMALL RESIDENT PROFESSIONALS (Section 44 ADA)

[Applicable for Professionals engaged in Profession referred to u/s 44AA (1)]

Gross Receipt upto Rs. 50 Lakhs

Deemed Profit – 50% of Gross Receipt

Issues related to Presumptive Profit that need Attention

- An Eligible Assessee is allowed to declare profits in excess of the Deemed Profit;

- If an Eligible Person wants to declare profit, lower than the Deemed Profit prescribed u/s 44AD or 44ADA, then he is required to get his accounts audited in accordance with Income Tax Act, 1961.

3. For Partnership Firms declaring their presumptive profit u/s 44AD or 44ADA, the Partners Remuneration and Interest are not allowed to be deducted from the ‘Deemed Profit’ derived under the aforesaid sections. They are presumed to be part of the expenses.

BENEFITS OF PRESUMPTIVE COMPUTATION OF PROFITS

- Exemption from the compliance burden of maintaining books of accounts.

- Exempted from advance tax and allowed to pay their entire tax liability before the due date of filling the return or actual date of filing their return whichever is earlier.

(E) RATE ON INCOME TAX ON COMPANIES

(i) DOMESTIC COMPANIES:-

| Category of Company | Rate of Tax |

| Domestic Companies with Turnover of upto Rs. 250 Crores (increased from 50 Crores) during the F. Y. 2016-2017 | 25% |

| Other Domestic Companies | 30% |

| Start-ups Registered from 01-04-2016 to 31-03-2021with Turnover not exceeding 25 Crores in 7 years from the date of Incorporation and [Section 80 IAC] | 0% – For 3 out of 7 years[MAT applicable under 115JB] |

(ii) OTHER NON-DOMESTIC COMPANIES

(1) on so much of the total income as consists of,—

| (a) | royalties received from Government or an Indian concern in pursuance of an agreement made by it with the Government or the Indian concern after the 31st day of March, 1961 but before the 1st day of April, 1976; or | 50% |

| (b) | fees for rendering technical services received from Government or an Indian concern in pursuance of an agreement made by it with the Government or the Indian concern after the 29th day of February, 1964 but before the 1st day of April, 1976, and where such agreement has, in either case, been approved by the Central Government |

(2) on the balance, if any, of the total income – 40 %

Rate of Surcharge –

- Domestic company

Total Income upto 1 Crore – NIL

Total Income > 1 Crore and upto 10 Crores – 7 %

Total Income > 10 Crores – 12 %

2. Other Companies

Total Income upto 1 Crore – NIL

Total Income > 1 Crore and upto 10 Crores – 2 %

Total Income > 10 Crores – 5 %

Health & Education Cess – 4% of the Income Tax & Surcharge (increased from 3% previously)

(i) Minimum Alternate Tax (M.A.T.) – Applicable where the Book Profits are more than Profits as per Income Tax Act, 1961.

(a) The rate of MAT payable by a company is 50% u/s 115 JB.

(b) The period allowed to carry forward the tax credit under MAT is further extended to 15 (Fifteen) years.

(ii) Dividend Distribution Tax (Sec 115 O) is 15% but in case of dividend referred to in Section 2 (22) (e) of the Income Tax Act, it has been increased from 15% to 30%.

(F) RATES OF DEPRECIATION UNDER INCOME TAX ACT

| ASSET | RATE OF DEPRECIATION |

| Plant & Machinery | 15 % |

| Computers including Software | 40 % |

| Motor Cars | 15 % |

| Furniture & Fixtures | 10 % |

| Building | 5 % |

(G) TURNOVER LIMIT FOR AUDIT UNDER INCOME TAX ACT

| CATEGORY OF ASSESSEE | LIMIT OF GROSS RECEIPTS/ TOTAL SALES/ TURNOVER |

| A person carrying on Business | Exceeding Rs. 1 Crore during the year |

| A person carrying on Profession | Exceeding Rs. 50 Lakhs during the year |

(H) TAXATION OF EQUITIES (SHARES) & DIVIDEND:-

| (i) | Short Term Capital Gain on Sale of Equities & EO MFs, on a Recognised Stock Exchange in India | Tax @ 15 % |

| (ii) | Long Term Capital Gain on Sale of of Equities or EO MFs or units of business, on a Recognised Stock Exchange in India:-

LTCG Tax = [(Sale Value – Cost) – 100000]*10%

For Shares acquired before 01-02-2018 – Cost shall be higher of Actual Cost or Fair Market Value (Fair Market Value is the highest price of a share on 31-01-2018 on any Recognised Stock Exchange but shall not exceed the Sale Price or full value of consideration)

[NOTE – To claim exemption u/s 10 (38) for shares acquired after 01-10-2004, it will be mandatory that the STT must have been paid at the time of Purchase.] |

Tax @ 10% |

| (iii) | Dividend Income upto Rs. 10 Lakhs | NIL |

| (iv) | Dividend Income above Rs. 10 Lakhs | 10% |

| (v) | Shares of Unlisted companies if sold after 2 years, shall be treated as Long Term Capital Gain | |

(I) RESTRICTION ON CASH TRANSACTION

In order to promote the digital economy, following restrictions have been imposed on Cash Transactions:-

| NATURE OF EXPENDITURE | I. T. SECTION | CEILING LIMIT | IN CASE OF VIOLATION |

| CAPITAL – Payment for Fixed Assets Purchase | 43 | 10000/- per day per asset | The expenditure shall not be included in the cost of asset. No Depreciation benefit. |

| Payment of Expenses on Specified Business | 35AD | 10000/- per day per asset | No deduction shall be allowed in respect of such expenditure. |

| Payment of Business Expenses | 40 A (3) | 10000/- per day to a person | No deduction shall be allowed in respect of such expenditure. |

| Payment made for plying, hiring or leasing goods carriages | Second Proviso to 40 A (3A) | 35000/- per day to a person | No deduction shall be allowed in respect of such expenditure. |

| Any Payment received:-(a) in aggregate from a person in a day;

(b) in respect of a single transaction; or (c) in respect of transactions relating to one event or occasion from a person, |

269ST | 2,00,000/- | Penalty u/s 271DA equal to the amount of such payment received by a person. |

(J) LATE FEES FOR DELAY IN FILLING OF RETURN OF INCOME [Section 234 F]

A person who is required to furnish a return of income under section 139, fails to do so within the time prescribed in sub-section (1) of the said section, he shall pay, by way of fee, as below:-

- If his total income is upto Rs. 5 Lakhs : Rs. 1000/-

- If his total income exceeds Rs. 5 Lakhs

– Return filled upto 31st Dec of A.Y. : Rs. 5000/-

– Return filled after 31st Dec of A. Y. : Rs. 10000/-

NOTE – As per Section 80AC, NO DEDUCTION UNDER CHAPTER VIA (SECTION 80A TO 80 TTA) OF THE INCOME TAX ACT, 1961 SHALL BE ALLOWED UNLESS THE RETURN OF INCOME IS FILLED WITHIN DUE DATE SPECIFIED U/S 139 (1) OF THE ACT.

#InterimBudget2019 #IncomeTaxRate2019-20 #IncomeTaxDeduction #https://www.indiabudget.gov.in/