The GST Council in its 22nd Meeting decided to suspend the Reverse Charge Mechanism (RCM) in case of purchases by a Registered Dealer from an Unregistered Dealer u/s 9 (4) of the GST Act.

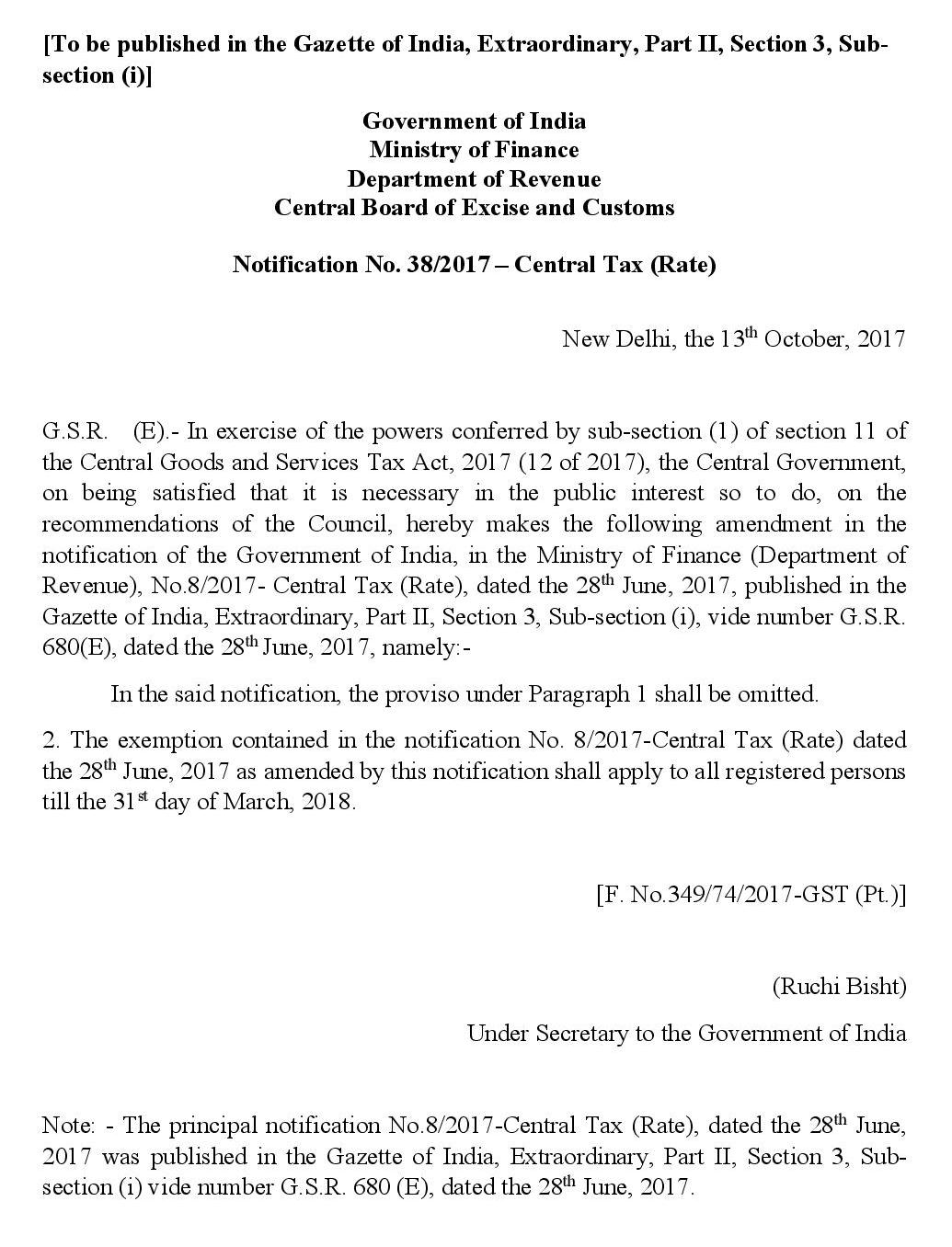

In this matter, the government has issued notification no. 38/2017 – Central Tax (Rate) dated 13-10-2017 by removing the proviso from Notification No. 08/2017 dated 28-06-2017, that restricted the exemption from RCM under section 9(4) upto a limit of Rs. 5000/- per day for Intra State Supply of Goods or Services received by a Registered Person from an Unregistered Person.

After this notification w.e.f. 13-10-2017 till 31-03-2018, a registered person can take INTRA STATE supplies of goods and services from Unregistered Person without any daily ceiling. Prior to 13-10-2017, a registered person was permitted to take supplies from unregistered person upto a ceiling of Rs. 5000/- per day in case of Intra State Supplies.

—

NOTES:-

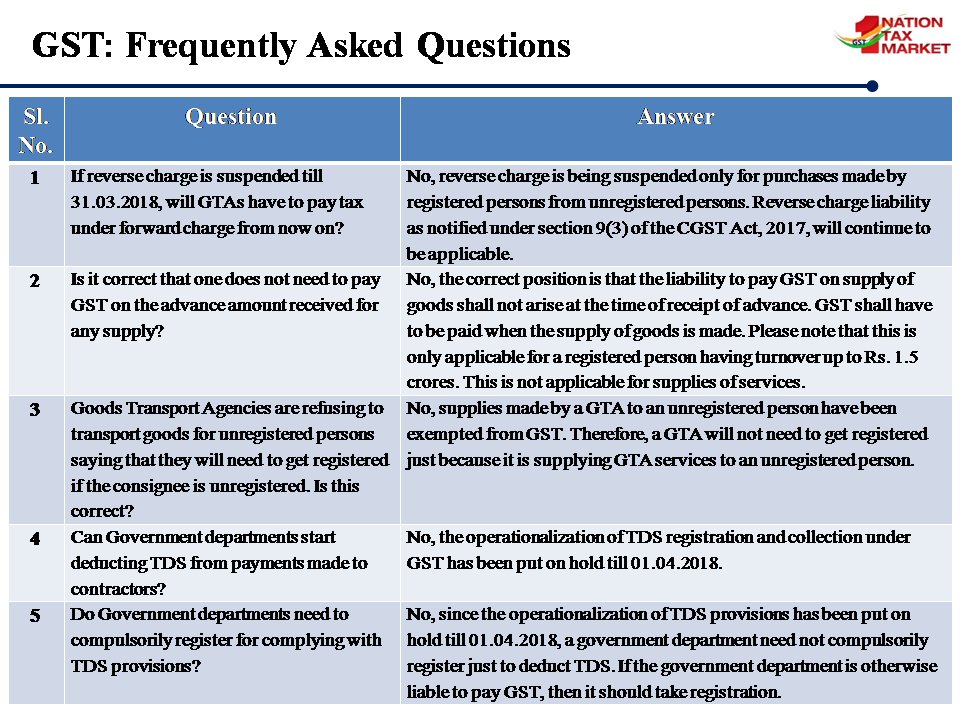

1. There is no change in the RCM Liability u/s 9(3) of the GST Act for specified services like GTA and payments to Government;

2. In case of receipt of supply of Services from Unregistered Dealers in case of Inter State Supply of Services, the exemption from RCM u/s 9(4) shall not apply.