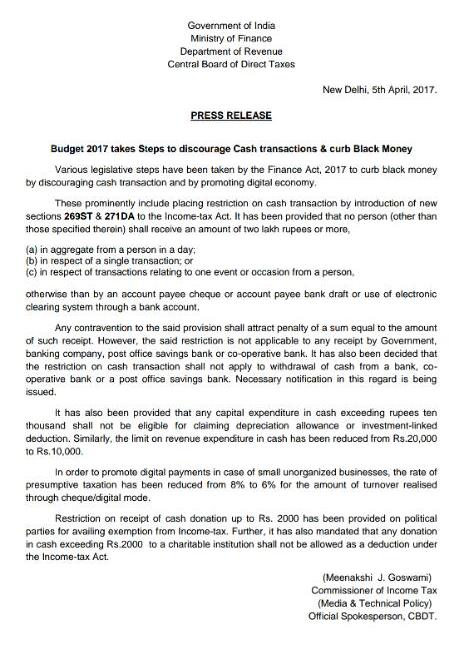

The Government has taken several steps for curbing black money, discouraging cash transaction and promoting digital payments. In this regard the government has issued a press release with brief of the initiatives taken by the government in this regard in the Budget for the FY 2017-18.

KEY INITIATIVES:-

A) Restriction on receiving Cash above Rs. 2 Lakhs [Section 269ST & 271DA of the Income Tax Act, 1961]

The government has placed restriction on cash transaction by introduction of new sections 269ST & 271DA to the Income-tax Act. It has been provided that no person (other than those specified therein) shall receive an amount of two lakh rupees or more,

(a) in aggregate from a person in a day;

(b) in respect of a single transaction; or

(c) in respect of transactions relating to one event or occasion from a person, otherwise than by an account payee cheque or account payee bank draft or use of electronic clearing system through a bank account.

Any contravention to the said provision shall attract penalty of a sum equal to the amount of such receipt.

However, the said restriction is not applicable to any receipt by Government, banking company, post office savings bank or co-operative bank. It has also been decided that the restriction on cash transaction shall not apply to withdrawal of cash from a bank, cooperative bank or a post office savings bank. Necessary notification in this regard is being issued.

B) Restriction on Capital Expenditure for Business in Cash above Rs. 10000/- [Section 32 of the Income Tax Act, 1961]

Where an assessee incurs any expenditure for acquisition of a depreciable asset in respect of which a payment (or aggregate of payment made to a person in a day), otherwise than by an account payees cheque/ draft or use of electronic clearing system through a bank account, exceeds Rs. 10000/-, such a payment shall not be eligible for normal/ additional depreciation.

C) Reduction in the limit of Cash Payment to Rs. 10000/- in a Day [Section 40A(3) & 40A(3A) of the Income Tax Act, 1961]

The monetary limit on revenue expenditure in cash has been reduced from Rs.20,000 to Rs.10,000 (there is no change in the monetary limit pertaining to cash payment upto Rs. 35000/- to Transport Contractors). Few exceptions are also provided in Rule 6DD of the Income Tax Rules. Consequently, any expenditure in respect of which payment (or aggregate of payment made to a person in a day), otherwise than by an account payee cheque/ draft/ use of electronic clearing system through a bank account, exceeds Rs. 10000/-, no deduction shall be allowed in respect of such payment under section 30 to 37 of Income Tax Act, 1961.

D) Lower Presumptive Profit of 6% for Cheque/ Digital Receipts by small businesses [Section 44AD of the Income Tax Act, 1961]

In order to promote digital payments in case of small unorganized businesses, the rate of presumptive taxation under section 44AD has been reduced from 8% to 6% for the amount of turnover realised through cheque/digital mode.

E) Restriction on Cash Donation above Rs. 2000/- received by Political Parties and Charitable Institutions

Restriction on receipt of cash donation up to Rs. 2000 has been provided on political parties for availing exemption from Income-tax. Further, it has also mandated that any donation in cash exceeding Rs.2000 to a charitable institution shall not be allowed as a deduction under the Income-tax Act.